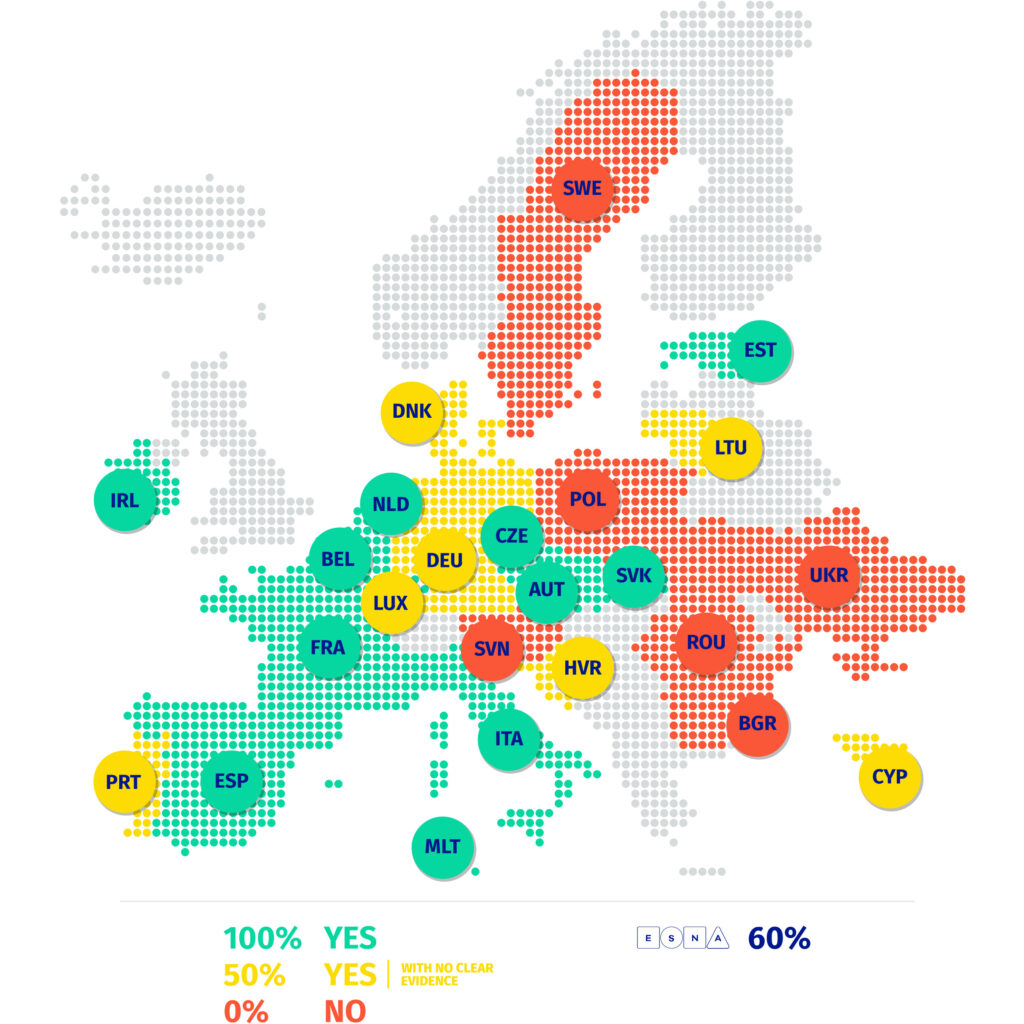

In recent years, Europe has made significant progress in fostering the startup ecosystem. The Startup Nations Standards (SNS) Report 2024, published by the Europe Startup Nations Alliance (ESNA), confirms this trend by analyzing 24 European countries.

Key Data from the Report:

- Average implementation rate: 61% for startup support policies.

- Access to funding: 72% average adoption.

- Talent attraction strategies: 64% implementation.

- Company creation: In some countries, starting a business takes less than 24 hours and costs less than €100.

Among the fastest-growing countries, the Czech Republic stands out for its innovation policies, targeted investments, and the dynamism of the tech sector. What are the strengths of the Czech startup ecosystem? What initiatives are driving its evolution, and what areas still need improvement?

In this article, we will analyze the Czech startup landscape in detail, examining the report’s data and the strategies implemented to make the country an increasingly attractive hub for entrepreneurs and investors.

SNS #1 – Fast Startup Creation, Smooth Market Entry

A dynamic entrepreneurial ecosystem requires fast and intuitive procedures. SNS #1 aims to simplify startup creation and market entry.

Key Measures Include:

- Fully online company registration in a few hours.

- Simplified access to EU markets for cross-border expansion.

- Multilingual support for entrepreneurs and startups.

Progress and Implementation:

- SNS #1 achieved an average implementation rate of 70% across the analyzed countries.

- 6 percentage points increase from the previous year.

- No country has reached 100% implementation, but this standard has the second-best performance.

Fast Startup Creation & Smooth Market Entry – 50%

The Czech Republic has implemented half of the measures to simplify startup creation and market entry. This includes the digitalization of bureaucratic processes and reducing business registration time.

To assess the implementation level of the Startup Nations Standards (SNS) in more detail, each standard is divided into measurable sub-standards:

1. TIME & COST – How much time and money are needed to start a business?

- Online registration: 2-4 weeks.

- Business registry entry: Within 1 week.

- Costs: Between €101 and €250.

2. STARTUP FAST LANE – Tools and support to accelerate startup creation.

- Online registration services: 50% implementation (the country offers an online service to start a business, but without clear evidence of its efficiency).

- Entrepreneur helpdesk: 75% implementation (only available in the local language).

- Virtual regulatory support: 100% implementation, offering a well-structured virtual support service with proven functionality.

3. CROSS-BORDER SERVICES – Ease of operating and registering businesses in other EU countries.

- Index of Cross-Border Services: 58% (below the top-performing countries).

- Countries like Estonia, Luxembourg, and Malta lead with 92% thanks to advanced digital ecosystems that facilitate international startup mobility.

- Only four countries, including the Czech Republic, do not accept EU legal documents.

SNS #2 – Attracting and Retaining Talent

Talent attraction and retention are crucial for startups and innovation. SNS #2 assesses the effectiveness of European policies in this area.

Czech Republic’s Decline in 2024

- Implementation dropped from 61% (2023) to 48% (2024), contrary to the general upward trend in Europe.

- Leading countries: Cyprus, Malta, and Romania (100% implementation).

Substandard 2.1 – Visa Applications

Visa processing times in the Czech Republic:

- Startup founders: 100% implementation (approval within a month).

- Skilled workers: 50% implementation (processing time between 1-3 months).

EU Comparison:

- 14 countries process startup founder visas in less than a month.

- Bulgaria, Slovakia, and Ukraine have faster entrepreneurial visa procedures.

- Denmark, Ireland, and Sweden offer better processing times for skilled workers.

Substandard 2.2 – Programs for Talent

- The Czech Republic lacks initiatives for returning tech professionals.

- Only 9 out of 24 countries have active programs with proven implementation.

Attractiveness for international talent:

42% score in the Index of Attractiveness for Entrepreneurs (below the EU average of 50%).

Top performers: Sweden (61%), Luxembourg (55%), Denmark and Ireland (54%).

SNS #3 – Stock Options

Stock options (SOs) are a key tool for attracting and retaining talent in startups. The SNS #3 standard assesses their implementation across Europe.

1. The Situation in the Czech Republic

- Implementation dropped from 33% (2023) to 4% (2024), indicating a severe lack of supportive policies.

- Leading countries: Cyprus, Estonia, France, Portugal, and Ukraine (100% implementation with favorable tax incentives).

2. Major Challenges for Stock Options in Europe

Obstacles to the adoption of stock options:

- High taxation and double taxation issues.

- Fragmented regulations across EU countries.

- Need for a unified tax regime to treat stock options as capital gains upon sale.

The report divides stock option implementation into three categories:

- Taxation (46%) – The lowest level of implementation due to fiscal complexity.

- Non-Voting Rights (69%) – Allows the issuance of stock options without voting rights, simplifying corporate governance.

- SO Scheme (71%) – Existence of national frameworks to regulate stock options, showing a growth trend compared to 2023.

The Situation in the Czech Republic

Stock Option Taxation: The Czech Republic does not tax stock options solely as capital gains but follows a mixed model, taxing them upon sale and through other methods. This creates uncertainty for startups and employees.

Voting Rights: The country does not allow the issuance of non-voting stock options, a feature that in other nations simplifies corporate governance and prevents excessive decision-making fragmentation.

Bureaucracy & Minority Shareholders: The Czech Republic scores 25%, indicating administrative obstacles and high costs in managing stock options for employees and minority shareholders.

Regulatory Framework: Currently, there is no specific legal framework for stock options in the Czech Republic, making their use complex and less attractive compared to other European countries.

SNS #4 – Innovation in Regulation

The Innovation in Regulation standard assesses the adoption of policies and regulatory tools aimed at reducing bureaucratic complexity and fostering innovation for startups.

1. Growth of the Czech Republic in 2024

- Implementation increased from 0% (2023) to 47% (2024), indicating significant improvement.

- This progress is linked to the introduction of more flexible regulations and the country’s growing focus on regulatory innovation.

- However, the Czech Republic still lags behind France, Estonia, and Spain (73%-100%).

2. Key Regulatory Tools for Startups

The Substandard 4 – Innovation in Regulation is divided into three main areas:

- Think Small First (60%) – Promotes policies tailored to SMEs and startups, adapting regulations to their specific needs.

- Compliance Exemption (29%) – Introduces exemptions or special regimes for innovative startups, reducing bureaucratic burdens.

- Regulatory Sandboxes (39%) – Establishes test environments with flexible regulations to experiment with new technologies and business models.

3. The Situation in the Czech Republic

Think Small First: Adopted, with recognition of the role of startups.

Compliance Exemptions: No exemptions provided, resulting in limited flexibility.

Regulatory Sandboxes: Only one active sandbox (20% implementation), with no Czech startups involved so far.

SNS #5 – Innovation in Procurement

The Innovation in Procurement standard analyzes the role of public institutions in fostering innovation through procurement processes, facilitating startups’ access to public contracts and intellectual property rights.

1. The Situation in the Czech Republic

- Implementation decline: 51% (2023) → 42% (2024).

- Challenges in innovative procurement and intellectual property management.

Czech Republic’s Procurement Landscape

- Public procurement and incentives:

No administrative barriers preventing startups from participating in public tenders.

Lack of incentives for public buyers to adopt innovative solutions.

- Intellectual Property Rights (IPR):

Startups can retain IPRs only in specific cases (50% implementation).

IPR-related revenues are low (8%), below the European average.

- Open-Source Assets:

No active policies supporting startups in contributing to open-source projects.

- Tech Transfer Policies:

100% implementation of policies for technology transfer between universities and startups, facilitating the creation of spin-offs and licensing agreements.

Comparison with Other European Countries

The average participation of startups in public procurement across Europe is 13%, an increase from 8% in 2023.Spain leads with over 100 startups involved in public procurement programs.

SNS #6 – Access to Finance

The Access to Finance standard evaluates the availability of financial instruments to support startup growth through public and private funding.

1. Growth of the Czech Republic in 2024

Implementation increased from 54% (2023) to 67% (2024).

Greater government commitment to fostering a stronger investment ecosystem.

2. Main Financial Instruments for Startups

- Public Grants – Direct public funding for early-stage startups.

- Indirect Access to Finance – Incentives for private investors and indirect financing tools.

- Tax Relief Measures – Tax benefits for startups and investors.

3. Comparison with Other European Countries

- Average SNS #6 implementation in the EU: 72%.

- France, Portugal, Spain, and Sweden achieved 100% implementation.

- 12 countries improved access to financing compared to 2023.

Substandard 6.1 – Public Grants

This substandard analyzes the role of public funding, particularly the Recovery and Resilience Facility (RRF), in strengthening venture capital for startups.

Czech Republic’s Situation

Full access (100%) to RRF funds for venture capital, used for investments, low-interest loans, and financial guarantees.

Substandard 6.2 – Indirect Access to Finance

- This substandard assesses indirect financial support for startups through promotional banking instruments and private capital diversification.

- European Investment Bank (EIB): 100% utilization to support venture capital.

- Private capital diversification: 100% implementation of measures to attract new investors and expand funding sources.

Substandard 6.3 – Tax Relief in the Czech Republic

- 0% tax incentives for Business Angels, discouraging private investment.

- No tax breaks to attract venture capital.

France and Sweden provide targeted incentives for early-stage investors.

SNS #7 – Social Inclusion, Diversity, and Protecting Democratic Values

Social inclusion in startups is essential to ensuring equal opportunities, diversity, and the protection of democratic values within the entrepreneurial ecosystem.

Situation in the Czech Republic

- 0% implementation in 2023 and 2024 – No active policies to promote inclusion and diversity.

- No programs supporting women, migrants, or disadvantaged groups in the startup sector.

- No initiatives to promote the protection of democratic values through entrepreneurship.

European Comparison

Some EU countries have introduced incentives for diversity, mentoring, and protecting democratic values.

The Czech Republic remains one of the few countries without concrete strategies in this area.

Substandard 7.1 – Incentives for Startups

Startup incentives aim to support the entrepreneurial ecosystem through awards, inclusion policies, and diversity incentives.

Situation in the Czech Republic

- No national awards or policies for startup role models.

- No initiatives promoting social inclusion and startup mobilization.

- 0% implementation of diversity incentives in hiring.

European Comparison

Several EU countries offer national awards for successful startups and inclusion incentives.

The Czech Republic is one of the few nations without dedicated strategies.

Substandard 7.2 – Incentives for Founders

Founder incentives aim to make entrepreneurship more accessible, supporting startups led by disadvantaged groups.

Situation in the Czech Republic

0% implementation of support for founders from disadvantaged backgrounds.

No measures to facilitate access to resources for entrepreneurs facing economic or social difficulties.

European Comparison

Some EU countries provide targeted incentives to ensure equal opportunities for founders.

The Czech Republic is one of the few countries lacking support policies in this area.

SNS #8 – Digital First

The Digital First standard evaluates the digitalization of startup processes and the adoption of innovative technologies.

Situation in the Czech Republic

- Slight improvement: Score increased from 45% (2023) to 47% (2024).

- Progress in digitalization, but still below the EU average.

European Comparison

Leading countries: Estonia, Denmark, Finland, the Netherlands, and Sweden, with advanced digital systems that simplify bureaucracy and accelerate startup processes.

The Czech Republic needs further investments to improve accessibility and digital efficiency.

Substandard 8.1 – Digital First Principle

The Digital First Principle assesses the digitalization level of public services for businesses, reducing bureaucracy and ensuring quick access to resources.

Situation in the Czech Republic

- 84% implementation in the Index of Digital Public Services for Businesses, slightly below the EU average (85%).

- 100% coverage in Digital Public Services Availability by Percentage of Areas Covered, indicating broad access to digital services.

- National digitalization strategy implemented, demonstrating government commitment in this sector.

European Comparison

Leading countries: Estonia, Denmark, Finland, and the Netherlands, offering fully digitalized public services.

The Czech Republic is close to the EU average, but needs improvements in automation and interoperability to compete with the best.

Substandard 8.2 – Digital Knowledge Sharing & Best Practices

This substandard evaluates a country’s commitment to proactively sharing digital knowledge and best practices to support startups.

Situation in the Czech Republic

- No active programs for proactively sharing digital knowledge and best practices.

- Lack of government initiatives to facilitate the spread of digital skills among startups.

European Comparison

- Some EU countries have well-established strategies for digital training and business support.

- The Czech Republic lags behind, limiting startups’ access to digital expertise and innovation.

AI-generated image.

Sources: sns-report-2024-5.pdf, https://scoreboard.esnalliance.eu/.