Introduction

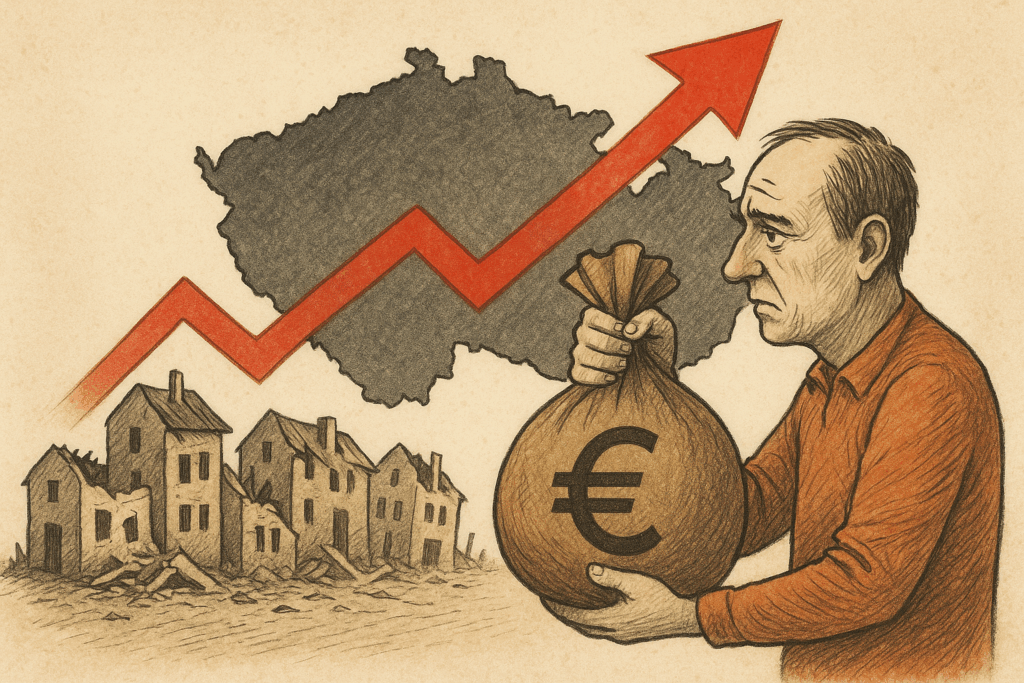

The number of personal bankruptcies in the Czech Republic is showing a concerning upward trend in 2025, with steady monthly increases since late last year. According to an analysis by CRIF – Czech Credit Bureau, based on data from www.informaceofirmach.cz, 1,512 personal bankruptcies were declared in April alone—an 18% increase compared to April 2024. This surge underscores growing financial pressure on Czech households.

Continuous Growth Since November 2024

The rise in personal bankruptcies began in November 2024 and has not slowed down. Between January and April 2025, a total of 5,595 bankruptcies were declared, marking a 14% year-over-year increase. Additionally, 5,567 new personal bankruptcy filings were submitted—17% more than in the same period last year.

Analyst Věra Kameníčková from CRIF noted that this increase is significant, with the number of filings surpassing those recorded in the final months of 2024. If this trend continues, 2025 may see some of the highest figures in recent years, comparable to the spike last observed in 2020.

Regions Most Affected

The distribution of personal bankruptcies across Czech regions reveals notable disparities. The regions with the highest number of filings in April 2025 include:

- Moravian-Silesian Region: 249 bankruptcies

- Ústí nad Labem Region: 221 bankruptcies

- Central Bohemian Region: 160 bankruptcies

In contrast, areas like the Zlín Region (45 bankruptcies) and Vysočina Region (52 bankruptcies) reported much lower numbers. Still, the Central Bohemian Region, traditionally more stable, is beginning to show signs of strain.

Annual Trends and Risk Levels

Looking at the 12-month period from May 2024 to April 2025, a total of 14,415 personal bankruptcies were declared—a 6% increase year-over-year. During the same time frame, 15,570 bankruptcy applications were submitted, up 9%.

The Ústí nad Labem Region remains the area with the highest risk, with 30 personal bankruptcies per 10,000 adults. The Moravian-Silesian Region follows closely with 23 cases per 10,000. Other high-risk areas include Karlovy Vary and Pilsen.

Despite a 14% annual increase in bankruptcies, Prague continues to be the most financially resilient region, along with Zlín. Both report only 10 personal bankruptcies per 10,000 residents.

What’s Driving the Increase?

Two main factors are behind the rising number of personal bankruptcies in the Czech Republic:

- Changes in bankruptcy legislation effective since October 2024, which made personal bankruptcy more accessible by easing application requirements.

- A rise in non-performing consumer loans, indicating a declining ability among households to repay debts.

These developments suggest that more individuals are seeking legal debt relief due to increasing financial hardship.

Conclusion

The spike in personal bankruptcies in the Czech Republic serves as a clear warning of growing financial instability. While legal reforms have made it easier for individuals to file for bankruptcy, the underlying causes—such as rising debt and lower repayment capacity—point to deeper economic issues. Close monitoring and proactive financial policies will be essential in the coming months to prevent further deterioration.

AI – image generated