In the Czech business landscape, IČO and DIČ are two of the most commonly used abbreviations. Whether you’re launching a company, collaborating with Czech partners, or issuing invoices in the country, understanding these identifiers is essential for legal and tax compliance.

This guide will walk you through what IČO and DIČ mean, how they differ, how to obtain them, and where to verify them.

What You’ll Learn in This Article

- What are IČO and DIČ?

- Key differences between IČO and DIČ

- How to get them (for companies and freelancers)

- Where to find the tax numbers of Czech entities

- Practical tips for starting a business in the Czech Republic

What Are IČO and DIČ?

▶ IČO – Identification Number

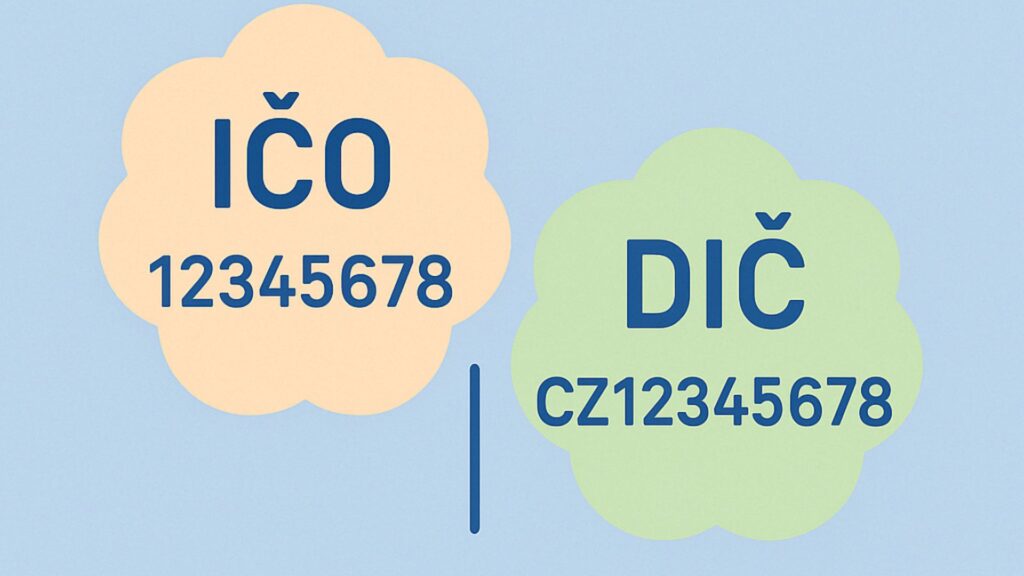

IČO (Identifikační číslo osoby) is an 8-digit identification number assigned to any entity conducting business activities in the Czech Republic. It applies to:

- Legal entities (e.g., limited liability companies)

- Self-employed individuals (freelancers)

- Government units with economic activities

📌 Format: 8-digit number

📌 Issued by: Trade Licensing Office or Commercial Court

📌 Purpose: General business identification

▶ DIČ – Tax Identification Number

DIČ (Daňové identifikační číslo) is the tax identification number used in all communications with the Czech Tax Office and especially for VAT (DPH) purposes.

📌 Format: “CZ” prefix + 8–10 digits

📌 Example: CZ12345678

📌 Issued by: Czech Tax Authority

📌 Note: Receiving a DIČ does not automatically make you a VAT payer.

Key Differences Between IČO and DIČ

| Aspect | IČO | DIČ |

| Purpose | Business registration and identification | Tax-related communication and obligations |

| Format | 8 digits | CZ + 8–10 digits (usually CZ + IČO) |

| Issuer | Trade Office / Company Register | Tax Office |

| Required For | All business entities | Only those subject to tax (income tax, VAT, etc.) |

| Shown On Documents | Contracts, invoices (except some professionals) | Invoices, tax documents (especially for VAT payers) |

How to Get IČO and DIČ

For Companies (e.g., s.r.o., a.s.)

- IČO: Issued upon registration in the Czech Commercial Register.

- DIČ: Assigned by the Tax Office after income tax registration. VAT registration may follow if thresholds are exceeded or voluntarily requested.

For Freelancers (živnostníci)

- IČO: Obtained during trade license registration at the Trade Office.

- DIČ:

- If not VAT registered: usually CZ + personal ID number

- If VAT registered: CZ + IČO

ℹ️ Regulated professions (like lawyers, doctors, accountants) receive their IČO from the Czech Statistical Office.

Where to Find and Verify IČO and DIČ

🛠 Online Tools:

- ARES: https://wwwinfo.mfcr.cz/ares/

- Czech government business registry

- Search by name or IČO

- Displays VAT status and company data

- VAT Payer Register

- Shows if a company or freelancer is VAT-registered

- Accessible via ARES

- VIES (EU VAT Validator): https://ec.europa.eu/taxation_customs/vies/

- Checks if a VAT number is valid and active within the EU

Where You’ll See These Numbers:

- Business websites

- Invoices and contracts

- Official government registries

- Public company profiles

Important: DIČ ≠ Automatic VAT Registration

Many businesses assume that having a DIČ means they are VAT-registered — this is incorrect.

You receive a DIČ upon income tax registration, but you only become a VAT payer if:

- Your annual turnover exceeds the Czech threshold (currently CZK 2 million)

- You apply for VAT voluntarily (e.g., for EU trade)

Practical Tips for New Businesses in the Czech Republic

Startup Checklist:

- Register your business properly (as a company or freelancer)

- Obtain your IČO and register with the Tax Office for your DIČ

- Determine if and when you need to register for VAT

- Use ARES and VIES to verify business partners

- Display IČO and DIČ correctly on your invoices and contracts

Example Use Case: Invoicing a Czech Client

If you’re a foreign contractor invoicing a Czech company:

- Always ask for their IČO and DIČ

- Verify their VAT status via VIES

- If you’re VAT registered in another EU country, apply reverse charge rules correctly

Conclusion

Understanding the roles of IČO and DIČ is critical for anyone operating within or doing business with the Czech Republic. These codes:

- Define your official identity in the business and tax system

- Are necessary for legal compliance, invoicing, and tax filings

- Help protect your business by ensuring your partners are properly registered

Whether you’re setting up a new company, contracting a Czech supplier, or entering the market as a freelancer, mastering these concepts will keep your operations smooth and compliant.

AI – generated image.

Sources: https://www.jake-james.cz/blog/ic-dic-rozdil-a-jak-zjistit